Certain states cap limit income. You’ll have high nursing home bills with too little income to cover it.

A number of states apply Medicaid income limits. These states are referred to as “Income Cap States. The legislature in each strictly limit the amount of income an applicant for Medicaid nursing home benefits can have and still qualify for benefits.

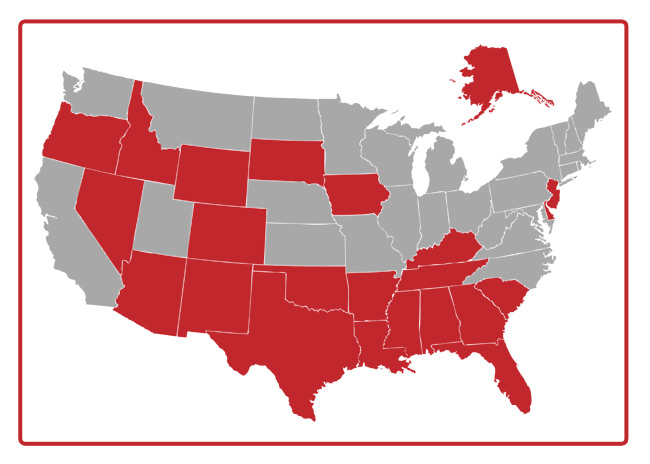

Income Cap States In 2022

- Alabama

- Alaska

- Arizona

- Arkansas

- Colorado

- Delaware

- Florida

- Georgia

- Idaho

- Iowa

- Kentucky

- Louisiana

- Mississippi

- Nevada

- New Jersey

- New Mexico

- Oklahoma

- Oregon

- South Carolina

- South Dakota

- Tennessee

- Texas

- Wyoming

Important note:

Income qualification is still possible- even if the applicant has “excess income” – by using the services of an elder law attorney. In Texas, when income exceeds the annual limit, you have a simple solution. It’s a special attorney drafted agreement known as a Miller Trust. Without a Miller Trust state law requires the caseworker to deny the application.

Medicaid Income Limits

In most states for 2022, the income limit for a single person seeking nursing home assistance is $2,523 of “countable income”. Some states set the limit higher. In Texas, the legislature sets that limit to $2,523.

Texas Medicaid considers income as payments bestowing a benefit to a household. Medicaid rules count some income when deciding how much a person must pay for care. Policy can also exclude certain income from that calculation. Factors specific to an income source determine if it’s countable.

Is Medicaid Eligibility Based on Income or Assets?

Medicaid uses both income and the value of a Medicaid applicants’ assets to decide eligibility. You will hear attorneys, nursing home personnel and caseworker also call them “resources”, “countable assets” and “countable resources.”

Medicaid rules offer a number of exceptions to what might be considered a “countable” resource subject to spending down. In Texas, the applicant’s personal residence, an automobile, personal jewelry, clothing and furniture and fully paid funeral arrangements are not counted toward financial eligibility.

When a senior’s resources exceed the Medicaid eligibility limit the applicant (and spouse, if married) must use part of those excess assets to pay for their expenses until they reduce down to the limit.

As long as one spouse is not seeking Medicaid help (called the “community spouse”), federal and state law allows married individuals to keep more assets than a single person. For 2022, federal law guarantees a minimum protection level of $27,480.

Medicaid has rules that protect assets. Sadly, most people are not aware state Medicaid policies exist that allow them to keep more of their life savings. The uninformed end up spending more than the law requires. Don’t let that happen to you.

Proper planning can save you and your family substantially more than the minimum spousal protection level. A person with resources that are greater than Medicaid’s limits may still be able to qualify for financial assistance.

Don’t over spend assets. Here’s a solution…

Find an elder law attorney experienced with Medicaid matters. The advice can prevent over spending for nursing home care. By using the laws, you can qualify faster and protect more assets and get eligibility.